Chapter 1 - Introduction

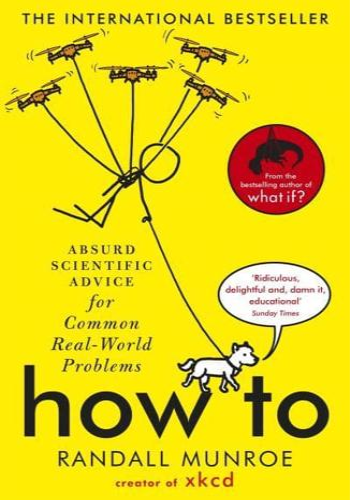

In Chapter 1 of How To, author William J. Bernstein introduces readers to the concepts of goal setting and personal finance. He explains that by setting goals, people are better able to track and use their resources wisely in order to improve their financial lives. As he puts it, “Without clear goals, financial navigation is like piloting a small sailboat by dead reckoning.” He outlines the steps to goal setting—from defining a goal to creating an action plan and taking action. He also illustrates the difference between short-term and long-term goals and shares advice about setting realistic goals. As an example, he suggests someone who dreams of becoming a millionaire might begin by setting a goal of increasing their income and savings by a few thousand dollars each year.

Chapter 2 - Risk

In Chapter 2, Bernstein introduces key concepts in risk-management. He explains that in taking on any sort of investment, there is an element of risk involved and investors must make sure that they understand the potential risks they’re taking on. To illustrate, he talks about how some stock investments offer higher potential returns than, for example, money market accounts but this increased return comes with an increased risk. He also offers advice for evaluating the risk associated with various investments in order to determine the best option. He explains that one way to do this is to look at historical data to gain an understanding of how certain investments have performed in the past.

Chapter 3 - Investment choice

In Chapter 3, Bernstein helps readers assess the various options available to them when it comes to investments. This includes stocks, bonds, mutual funds, and exchange-traded funds (ETFs). He provides an overview of each type of investment, what it can offer and some of the risks associated with it. For example, he explains that stocks typically offer higher potential returns but also have a higher degree of risk than other types of investments. He advises readers to consider their goals and risk tolerance when determining which investments to make. He also shares advice on diversifying investments and suggests creating a portfolio that includes investments with varying degrees of risk.

Chapter 4 - Tax Strategy

In Chapter 4, Bernstein helps readers understand the various strategies they can employ when it comes to managing their taxes. He discusses ways to reduce taxes for both short-term and long-term investments. For example, he explains that investors may be able to take advantage of deductions, tax credits, and other tax breaks in order to reduce their overall tax burden. He also provides strategies for timing investments in order to reduce tax liabilities in the future. As an example, he suggests that investors may want to time the sale of certain investments in order to take advantage of opportunities such as capital gains tax breaks.

Chapter 5 - Results

In the final chapter of How To, Bernstein encourages readers to review their results. He explains that it’s important to analyze and assess how well the investments they’ve made have performed in order to determine whether or not they’ve achieved their goals. He talks about the importance of creating both a timeline and a budget to help track progress and sticking to it in order to reach financial success. He provides practical tips and strategies for monitoring investments and savings, as well as advice on adjusting strategies if needed. To wrap up, he encourages readers to use their goals to set a course for success and to keep a positive attitude—even when the going gets tough.